In honor of Bastille Day All the Swirl's friend and ear to the ground at the 2015 En Primeurs, Devon Magee, reports on the whirlwind experience and how a tasting of such pre-adolescent wines thousands of miles away affects wine prices around the world.

Devon Magee. Photo Courtesy of Devon Magee.

Ah, “En Primeurs” – the annual dog and pony show when the most prestigious Chateaux open their doors to pour a 1-ounce taste of their infant wine, just plucked from the vine six months prior. What a truly unique experience! Which other wine region can convince its clients to fly across the world – from China, the U.S., and the wealthy, wine-collecting countries in between – all the way to Bordeaux, France, to taste an (often aggressively) unfinished product?

That is the magic of the Bordelais. Their impeccable demeanor – from colored corduroy pants to their matching silk handkerchiefs, their cashmere scarves and and initialed shirt cuffs – is aristocracy personified. This panache is ingrained in Bordeaux’s wine as much as its people, and you can’t help but be spellbound. I might not own a tailored tweed suit from Saville Row and, unfortunately, I can’t afford to drink Bordeaux’s 1st Growths either (or even its 2nd, 3rd, 4th, or 5th Growths). But as a salesman for the leading Bordeaux wine retailer in the U.S., I am invited every year, for one week, to put on my best sports coat, taste and promptly spit the best Bordeaux from sunup to well beyond sundown.

Moonscape vineyard at Paulliac. Photo courtesy of Devon Magee.

Bordeaux’s landscape is flat and indistinguishable, especially during En Primeurs which always takes place the first week of April. Let me clarify: the city of Bordeaux is beautiful, and there are actually vineyards and Chateaux within the city’s bounds (such as Chateau Haut Brion). The town of St. Emilion, the picturesque wine hub on the Right Bank, is even a UNESCO world heritage site. But unless you’re in Bordeaux as a mere, pleasure-seeking tourist, you’ll be spending precious little time in either place.

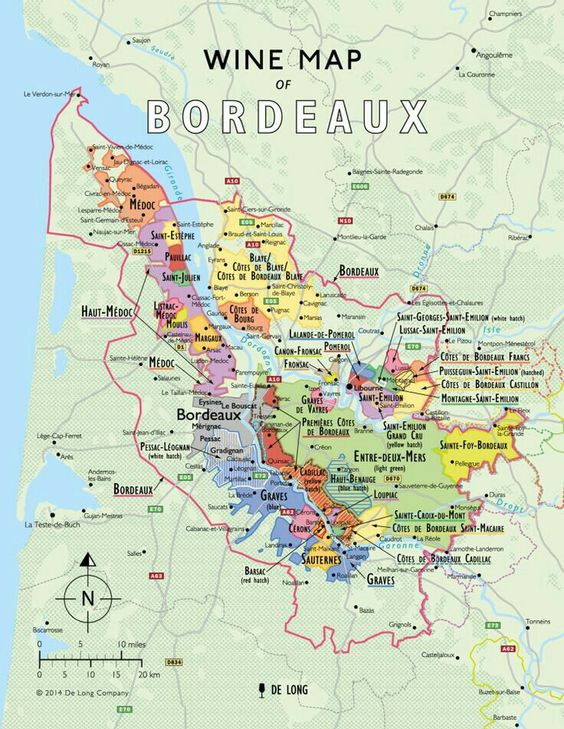

Map of Bordeaux wine growths. Image courtesy of De Long Wine.

Instead, you’ll be crisscrossing the Medoc, the moonscape peninsula north of Bordeaux, home to almost all 60 of Bordeaux’s Classified Growths. Here, you can catch a glimpse of pre-Revolutionary France: giant, ash-colored Chateaux dotting gravel-strewn, barren land but for the twisted fingers of leafless grapevines. It is early April after all, in a marginal, northern maritime climate where you can expect drizzly mornings. But if you look closely at the weathered, dark brown vines, you will see the nascent buds of shoots that will undoubtedly yield a good to extraordinary vintage this year.

You visit dozens of Chateaux in 15-30 minutes intervals, whisked into crowded tasting rooms by hurried French women in uniform scarves, where you taste the Grand Vin (amongst the Chateau’s ‘lesser’ wines) until they all run together and you can’t distinguish the Leovilles from one another, or discern any distinct terroir among the endless acres of vineyards that line the muddy river to the east.

At lunch and dinner, you fill yourself with bottomless foie gras, cured ham, unpasteurized cheese, veal, lamb, and baguettes. Somehow wine tasting, despite its minimal physical activity, awakens an immediate, aggressive hunger only satisfied by a sickening gavage that makes you wonder if, in some kind of Kafkaesque twist of fate, the goose liver is actually fattening YOU up.

You wash it all down with back- or off-vintage Grand Vin, second and third wines, while you dream of a hoppy American IPA and spicy Mexican food over mundane conversation with the aristocracy (almost always men!), who are eternally deaf to your client-driven concerns about 2015 Bordeaux pricing.

There are no more “bad” vintages in Bordeaux, just like there are no more candid winemakers or Chateau owners. To be fair, technology has greatly improved since the 1970s, when producers simply didn’t have the toolbox to fix a string of absolutely crappy vintages. Today, optical sorters jettison any imperfect berry, while drones and infrared sensors chart the vineyards for productivity and ripening

Robert Parker. Photo courtesy of Forbes.

Once upon a time, before an unknown lawyer from Maryland named Robert Parker hung his hat, and made his name on the unparalleled quality of the 1982 vintage, before Chinese billionaires and French insurance companies began buying up Chateaux, En Primeurs really did serve a purpose. Wine merchants would travel to Bordeaux to taste and buy the previous vintage two years before it was bottled. This set a (low) cost of entry for merchants to a scarce, collectible commodity that would presumably only appreciate while guaranteeing immediate income for growers and winemakers who couldn’t physically release their goods to market for two years (Bordeaux reds typically spend 18 months in barrel and 6 months in bottle before landing on the shelf).

Fast-forward to 2009, when Mr. Parker, now the Federal Reserve of the wine world (his points for wines can propel or crash a region’s vintage) finds the next 1982 vintage 37 years later. Is it a coincidence that he would retire from tasting and scoring Bordeaux En Premier after the 2012 vintage? Maybe, but in any case, the vintage was uniquely ripe and delicious, and he handed out an unprecedented eighteen 100-point scores.

The 2010 vintage followed, also extraordinary, and Bordeaux prices hit a new high-water mark. The 1st Growths sold for over $1,000 on release. The 2011, 2012, and 2013 vintages followed at a mediocre pace. The 2014 was good – “better than 2008, but not as good as 2009 or 2010,” as one winemaker put it, stretching to lift it above the three previous vintages. In Bordeaux-speak, the modern-day off vintages become “challenging, unique,” and, most importantly, extremely low-yielding. Without the superlative quality, the vintages propped themselves up on their scarcity, like the Chateaux’s turn of the century furniture.

Bottles of Chateau Lafite. Photo courtesy of Jing Daily.

Release pricing adjusted down from its all-time high accordingly, until Bordeaux hit its lowest prices since the 2008 vintage in 2013, when the 1st Growths released for under $400. Meanwhile, the Chateaux continued to trickle out their 2009s and 2010s, the Chinese government suddenly stopped greasing their bureaucratic wheels with gifts of Chateau Lafite, and the Euro started to slide against the dollar. The result – you could suddenly pick up ’09 and ’10 1st Growths for under $800. If you had followed the rules and played the centuries’ old Futures game, your investment had depreciated by a couple of hundred dollars per bottle.

So what about 2015? Surely, after four flat vintages, Mother Nature had to award Bordeaux with something! The Bordeaux-speak started before the grapes were even ripe. All indicators pointed to an extraordinary vintage (translation – the vineyards survived the spring and early summer without any natural weather disasters like hail, torrential downpours, or frost).

In April, we arrived in Bordeaux to this audible chatter. We heard about how the top Left Bank Chateaux either missed the July and August rain, or received just enough July and August rain after a dry summer. We heard about how instrumental Cabernet Franc and Petit Verdot were on the Right Bank. We listened as the winemakers and Chateau owners undressed their wines to describe each part – the ripe fruit, the floral notes, the acidity, the structure, the integrated tannins – except for the yields. They would never admit to normal yields.

Standard En Primeurs tasting lineup | Photo courtesy of Devon Magee

And then we tasted the wines, and here is the disconnect. Imagine examining Michael Jordan, Ernest Hemmingway, or Mozart in their infancy. Could you really pick out the extraordinary talents that would propel each of them to greatness as adults? If there is one common thread in tasting Bordeaux wine six months after it was harvested in grape form, it is how disjointed it is, like a stumbling Michael Jordan as a toddler. And if there is a second common thread, it is how these young, tannic, unbridled wines numb your mouth almost to the point of paralysis.

Okay, to not sound too cantankerous. I admit that there is a Mozart from time to time – a wine that gives you a glimpse of what it will become. Despite all of its romanticism, this is what En Primeurs is really about – finding these wines.

For 40 vintages, from the 1982 through the 2012 vintage, Robert Parker guided the American consumer through the Bordeaux Futures landscape with barrel scores, which he published right after the En Primeurs event and right before the Futures pricing staggered release from May through June. And for those 40 vintages, he was, for better and for worse, the driving force behind the American market. Even if I discovered my own Mozart and wanted to share it with my clients, if Parker didn’t concur with a high enough rating, then my recommendation would literally fall on deaf ears.

In today’s post-Parker era, the landscape is slightly different, albeit still score-driven. Three major Bordeaux critics (James Suckling, Antonio Galloni, and Neal Martin) vie to fill the vacuum that Parker left. This gives the consumer more palates, and more opinions, to align with, yet it also dilutes any one championing voice.

More importantly, Parker’s absence freed individual Bordeaux producers from hinging their score-driven success on the over-the-top, opulent style that Parker loved. In 2015, when Mother Nature did deliver all of the building blocks to make an excellent wine in any style, I tasted a plethora of stylistic choices made by each Chateau as they realigned with their traditional past, or continued down the hedonistically thrilling road paved by Parker.

Photo courtesy of James Suckling.

The Futures Campaign ended a few weeks ago when the 2015 Petrus came out just before the British wine market’s Brexit doomsday. It’s over $2,000, if you can find it, almost on par with the 2009 and 2010 releases.

No winery will admit to producing a bad wine that Bordeaux has declared as extraordinary, so each wine’s status level (i.e. its classified growth) dictates pricing more than the individual wine’s prowess (if that could ever objectively be determined!) The 2015 1st Growths all released at just over $500 per bottle, the highest since 2010, yet still much lower than the ’09 and ’10 high water marks. The Second Growths all jumped up considerably from their 2014 release prices – right around $150 and up, almost matching the ’09 and ’10 prices.

Both Pavie and Angelus, new members of the Premier Grand Cru Classeé A in St. Emilion (a distinction they share with Ausone and Cheval Blanc), released at over $300, a new high water mark. It would seem that the antiquated 1855 classification that permanently established the Left Bank’s five-level classification still dictates pricing today, and has spread to the Right Bank.

James Suckling. Photo courtesy of James Suckling.

So how successful was the vintage? If you have the expendable income, sure, it makes sense to collect the best wines from the vintage. Unlike Great Britain post-Brexit, this vintage will not get downgraded from its triple-A rating. Off-vintage first growths sell for $350 at its lowest, and there are enough mediocre vintages to fill in pricing from there to the $500+ 2015s that there is very little risk that these wines will depreciate in price.

The Bordelais even went one step further to ensure your 2015 Futures investment. In a lesson learned from OPEC, they released considerably less wine onto the market than ever before, creating scarcity even in a high-yield, high-quality vintage.

Is there a financial upside to buying these wines now? Maybe, and maybe not. Today, the top producers simply don’t make bad wines anymore, regardless of vintage characteristics. And there’s a reason why Bordeaux has been the most collected wine for centuries (beyond the proximity by boat to England) – it really does age fantastically well.

What does this all mean for the rest of us – the half-a-bottle-a-day, wine working class? The good news is that there is an abundance of high quality wine produced in Bordeaux at every price point (unlike our neighboring Napa, for instance). Maybe Reaganomics finally found its home in the backwards, anachronistic Bordeaux wine market. There is so much top-heavy investment in Bordeaux right now that resources literally trickle down to less branded, unclassified producers.

Photo courtesy of Wine Searcher.

And money really does follow money here. International investors have been targeting Bordeaux as a safe, lifestyle investment, regardless of early economic returns (and the longtime French owners are often happy to sell to avoid debilitating inheritance taxes). The feather in their cap is the quality of the wine itself, not the price per bottle (at least initially). And let’s be honest – the price paid per Chateau is virtually unrecoupable in bottles sold. Take the 5th Growth darling, Chateau Pontet-Canet, for example. For years, it struggled in mediocrity and in need of, like most of its neighbors, serious investment to turn the corner to modernity. Alfred Tesseron, the Cognac giant, took over in 1994, and, through investment and fastidious attention to vine growing and winemaking, lifted the wines to 1st Growth quality levels – for a fraction of the price.

I know, it sounds like a sales pitch, but my point is that there are dozens of other similarly-endowed Bordeaux wineries out there who do have the opportunity, especially when weather cooperates as it did in 2015, to make exceptional wine at affordable price points. I for one look forward to enjoying them all (along with the odd bottle of ’15 Petrus), once they hit our shores in two years, in their more revealing, albeit precocious, adolescence.

All the Swirl is a collections of thoughts and opinions assembled by the staff and industry friends of Charles Communications Associates, a marketing communications firm with its headquarters in San Francisco, California. We invite you to explore more about our company and clients by visiting www.charlescomm.com.